Technical analysis attempts to predict future price movements in financial markets by studying past market data. Investors utilize various tools and indicators, such as chart patterns, moving averages, and oscillators, to uncover potential trends and signaling buy or sell opportunities. By examining these market signals, technicians strive to gain

Understanding Equal Weight ETFs: A Comprehensive Guide

Equal weight exchange-traded funds represent a unique approach to portfolio construction by allocating equal weights to each holding within the fund. This approach differs from traditional market-cap weighted ETFs, which give larger weightings to companies with higher market capitalizations. By distributing assets uniformly, equal weight ETFs aim t

A Deep Dive into Performance

The S&P 500 is a widely recognized barometer of the overall U.S. stock market performance. However, by segmenting this broad market index into distinct industries, investors can gain deeper insights into specific economic trends and market risks. Sector ETFs provide a targeted approach to investing in these segments, allowing investors to tailor th

Exploring Consumer Staples in a Volatile Market

The XLP ETF offers a compelling strategy for portfolio managers seeking to diversify their portfolios within the resilient consumer staples sector. In a dynamic market environment, XLP enables exposure to renowned companies that manufacture essential goods and products. However, it is essential for analysts to analyze the specific challenges facin

Edward Furlong Then & Now!

Edward Furlong Then & Now! Angus T. Jones Then & Now!

Angus T. Jones Then & Now! Jenna Jameson Then & Now!

Jenna Jameson Then & Now! Robbie Rist Then & Now!

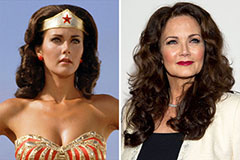

Robbie Rist Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now!